| |

|

|

| |

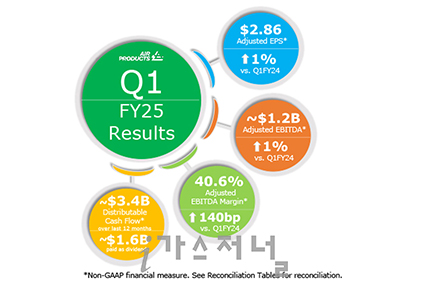

Air Products today reported first quarter fiscal 2025 results, including GAAP EPS of $2.77, up one percent from the prior year. GAAP net income of $650 million was up five percent as higher pricing, net of power and fuel costs, was partially offset by higher costs related to shareholder activism, incentive compensation, and inflation. These costs were partially mitigated by productivity improvements. The Company also recognized lower non-service pension costs as well as a gain on de-designated cash flow hedges. GAAP net income margin of 22.2 percent increased 150 basis points due to these factors as well as favorable business mix.

Air Products' first quarter GAAP results for the current and prior year include items that are adjusted in the non-GAAP measures discussed below. First quarter fiscal 2025 items include costs of $0.10 per share associated with shareholder activism and $0.04 per share for non-service pension costs, partially offset by a gain of $0.05 per share on de-designated cash flow hedges. Items for the prior year quarter included non-service pension costs of $0.08 per share.

For the quarter, on a non-GAAP basis, adjusted EPS of $2.86 increased one percent from the prior year. Adjusted EBITDA of $1.2 billion was up one percent as higher pricing, net of power and fuel costs, was partially offset by higher costs and lower equity affiliates' income. Adjusted EBITDA margin of 40.6 percent increased 140 basis points primarily due to favorable business mix and higher pricing.

First quarter sales of $2.9 billion were down two percent from the prior year as two percent lower volumes and one percent unfavorable currency were partially offset by one percent higher pricing. The lower volumes were driven by the divestiture of the LNG business in September 2024 as well as a lower contribution from on-sites and merchant in Europe, which were partially offset by a significant, non-recurring sale of helium to an existing merchant customer in the Americas. The impact attributable to the LNG divestiture was approximately 2%. |